I was ticking off the first couple of things in my start-up checklist. I had zeroed in on the business idea, decided what problems my startup will solve, came up with a fitting name, found an enthusiastic co-founder, and even settled down in our brand-new office.

But as a startup on the road to building a global company, with ambitions to cater to a diverse international clientele, there loomed another major complication: how do I equip our startup to reach an international audience? How do we go about incorporating SurveySparrow in the U.S?

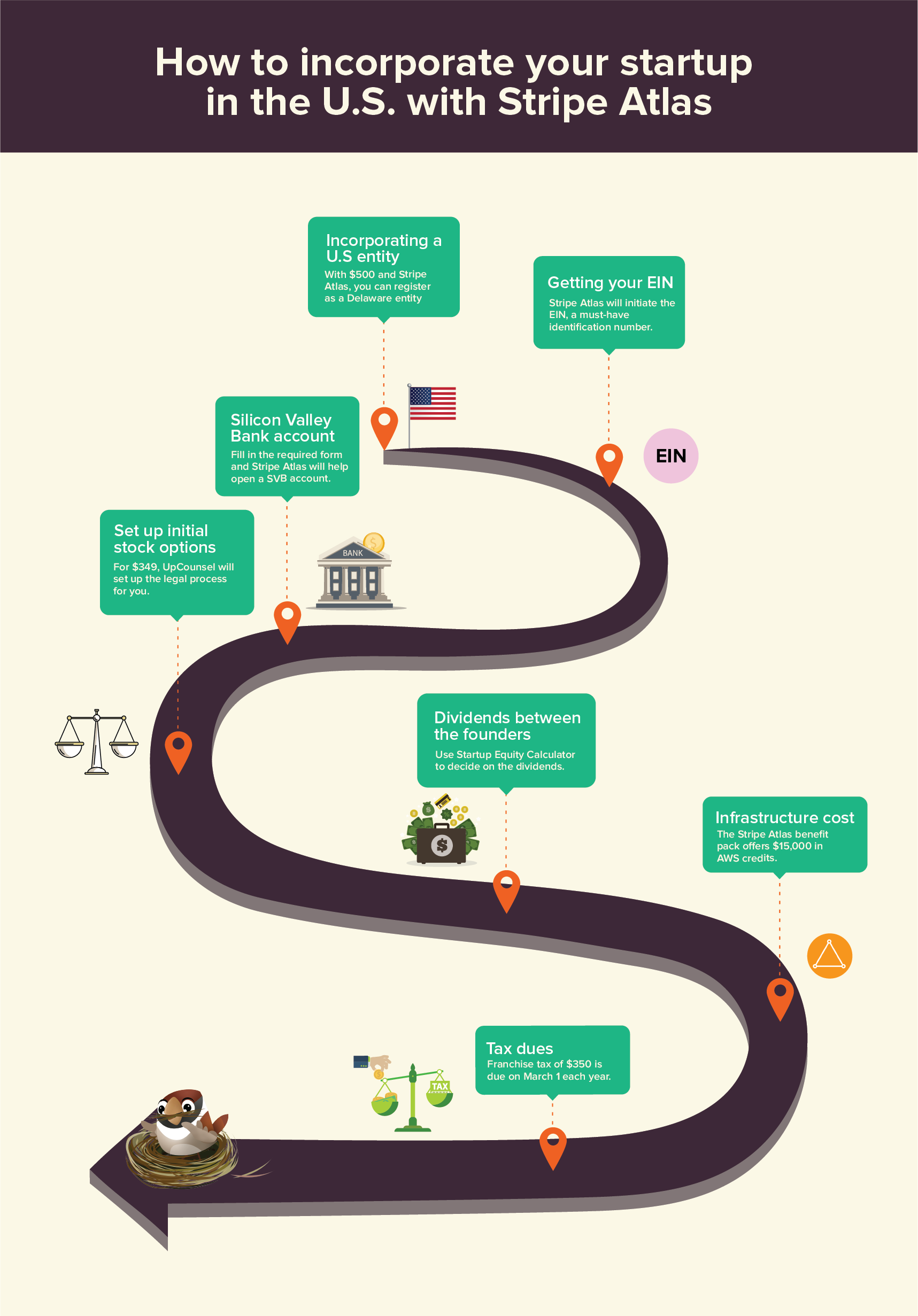

This is the story of how we incorporated in the U.S with some smart resources and just $500 using Stripe Atlas: a one-of-a-kind product built by Stripe to help entrepreneurs across the world incorporate in the U.S in a matter of days.

Let me tell you how we went about incorporating SurveySparrow in the U.S.

1. Incorporating a U.S. Entity

Half a million businesses, including more than half of all U.S publicly-traded companies and 60% of Fortune 500 companies, have incorporated in Delaware.

Incorporating your company in Delaware is industry standard for tech companies and since it matched our needs, we did too.

Stripe Atlas incorporated SurveySparrow in Delaware in a matter of days. They generated the necessary documents, filed the paperwork, and obtained our Tax ID number for us. The process was smoother than I would have thought possible.

2. Employment Identification Number (EIN)

To deal with banks and manage other critical business proceedings, having an EIN is essential.

An EIN is a unique number assigned by the Internal Revenue Service(IRS) to business entities operating in the United States, for the purposes of identification. You need an EIN to pay Delaware taxes and for opening a bank account. Stripe applied for an EIN on our behalf and I was in receipt of our EIN within a few days of our incorporation.

3. Opening a Silicon Valley Bank Account

Opening a U.S bank account as a non-US founder is no easy feat. Further to the requirements of being physically present in the U.S, getting someone to introduce you to a bank and then paying the high maintenance fees and minimum balances associated with them, there is a lot of work involved.

However, Stripe Atlas has partnered with Silicon Valley Bank (SVB), enabling us to open a fully featured bank account. Stripe initiated our Silicon Valley Bank account process once we filled the form and our account was activated once we received our EIN number.

4. Legal process with UpCounsel at $349

Through their partnership with Stripe Atlas, UpCounsel helped us setup our initial stock options for just $349. It was money well spent, helping to demystify decisions on total shares, how they were shared, the time vested, and how vesting would accelerate in case of a triggering event. Decisions around equity distribution have a long-lasting effect on your business and it certainly brings peace of mind knowing that you’ve started on a solid foundation.

5. Dividing the Pie

Reaching a consensus on dividends is an otherwise tricky puzzle, but this Startup Equity Calculator was extremely useful in dividing our pie between founders. And when we wanted to offer stock options for all our employees, Capshare helped us do a free evaluation of our company.

6. The Stripe Atlas Benefit Pack

Another feature I appreciated was how Stripe Atlas helps you start your business with absolutely no infrastructure cost. It comes with up to $15,000 in AWS credits.

7. Delaware Franchise Tax

Any business entity that is incorporated in Delaware (regardless of where you conduct your business) must pay Franchise Tax. Franchise Tax is due on March 1 of every year. It comes to around $350 per year (Assumed Par value capital method) in addition to a filing fee of $50. As one of the partners within the Stripe Atlas network, PwC provided us with a comprehensive guide to managing our U.S tax obligations, allowing us to decipher and settle the required sum with ease.

By taking on the heavy-lifting, Stripe Atlas has made it possible to start and scale a global business faster than ever before. Without having to worry about complicated legal work and the associated admin with setting up a business, founders can now channel their limited time and resources into nurturing their ventures.

SurveySparrow has some mighty shoes to fill as a great Typeform alternative, and we count on making it big as one of the best online survey tools. I am plain grateful that the startup ecosystem has evolved over the years to favor founders. When a large chunk of the tedious legal work is already taken care of, I think one can afford to dream a tad bit more in his spare time. Not that you’ll have much time to spare with a business to nourish, but it’s sure nice to have options!