Payment Experience: What is it & How to Improve it?

Kate Williams

Last Updated: 21 October 2024

12 min read

You are running an online eCommerce business. Though you are getting a considerable amount visitors, you have been seeing a high volume of cart abandonment.

The customer liked the product, which is obviously the reason why they chose to move it to the cart. But still, it’s not going further than that. One key reason why this happens is most likely because of your payment experience.

The process might be lengthy, or you may not be providing the necessary payment portals your customers want. Either way, you are losing customers, and it’s high time you start looking into it.

Similarly is the case for B2B businesses. If your payment process is poor, it’s not likely that they are going to stay with you for a while.

So, if you are someone who genuinely wants to improve your payment experience, this blog is for you.

What is Payment Experience?

The overall perception and satisfaction a user gets when completing a financial transaction is called a payment experience.

Keep in mind that this experience is not confined to just the transaction. It actually encompasses every touchpoint from the moment the user decides to make the transaction to completing it.

Now, from the user’s perspective, the payment experience is often a decisive factor in their relationship with a merchant. A positive experience is one where the payment process is so smooth and hassle-free that it almost feels invisible.

Key aspects include:

- Speed: Transactions should be processed quickly, without unnecessary delays.

- Security: Users need to feel confident that their financial information is safe.

- Simplicity: The process should be straightforward, without complicated steps.

- Flexibility: Offering multiple payment methods to accommodate different preferences.

A well-designed payment experience considers the user’s journey from start to finish. This ensures that every step is optimized for ease and efficiency.

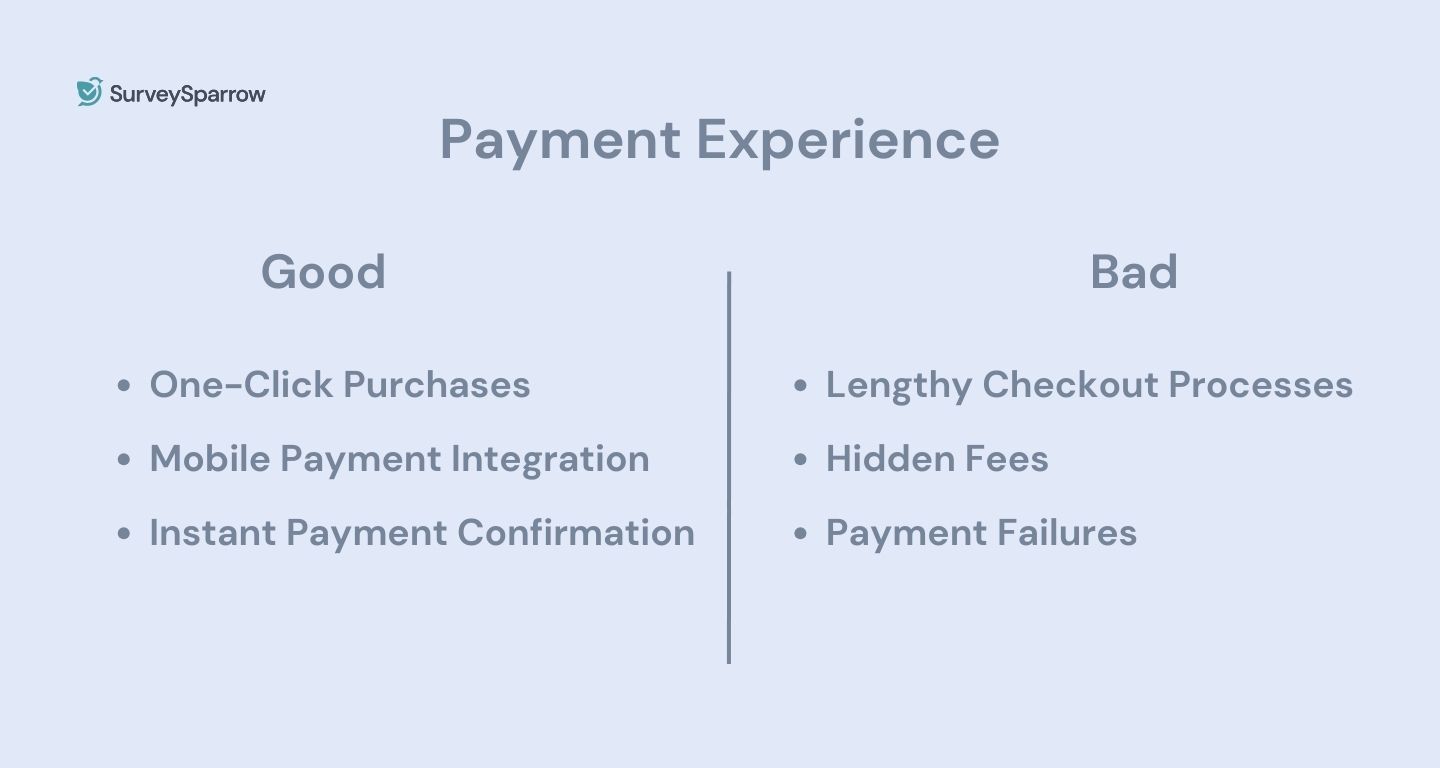

Examples of Good Payment Experiences

- E-commerce sites that remember your payment information (securely) and allow you to complete a purchase with a single click.

- Using smartphones to make payments quickly. It can be either online through apps like Apple Pay or Google Wallet or in physical stores through NFC technology.

- Receiving an immediate confirmation message or email after making a payment. This reassures the customer that the transaction was successful.

Examples of Bad Payment Experiences

- Being forced to fill out multiple forms or navigate through several pages just to make a simple payment.

- Discovering additional charges at the final step of payment. No one needs this, and you know it.

- Transactions that fail without a clear explanation can force the user to start the process over or abandon it entirely.

It’s always possible to improve the payment experience. But, the key thing for that is to understand the customers’ needs and frustrations. And for that you’ll need a customer feedback tool like SurveySparrow.

Explore Deeper Customer Insights with SurveySparrow

Try it for Free!

14-Day-Free Trial • Cancel Anytime • No Credit Card Required • Need a Demo?

What is Payment Processing Experience?

Payment processing experience is a crucial component of the overall payment experience. It focuses on the mechanics and operations occurring behind the scenes during a transaction.

The key elements included here are the technical and business processes involved in moving funds from one account to another. Or from a customer’s account to a merchant’s. At its core, payment processing involves several key players:

- The customer

- The merchant

- Payment gateways

- Acquiring banks

- Issuing banks

The experience is shaped by how smoothly and securely these entities interact to complete a transaction. From when a customer inputs their payment details to when the merchant receives the funds, numerous checks are performed to ensure accuracy, security, and efficiency.

Let’s consider an example to give you a proper idea of the technicalities involved during a transaction. Imagine you’re buying a coffee at your favorite cafe. You tap your card on the payment terminal, and in just seconds, you receive a notification that the payment was successful.

What seems like a simple tap involves a complex journey:

Authorization:

The payment terminal sends your card details to the payment gateway, which forwards them to the acquiring bank. The bank then sends a request to the card network (Visa, MasterCard, etc.), which finally requests authorization from the issuing bank (your bank).

Authentication:

Your bank verifies the transaction is legitimate (checking for sufficient funds, correct PIN, etc.) and sends an approval (or denial) back through the chain to the merchant.

Settlement:

Once authorized, the transaction details are batched to be settled, which means the funds are transferred from your bank to the merchant’s bank. This can take a few days.

It’s true that customers don’t always see this process. But, it significantly affects their perception of a merchant’s efficiency and reliability. Therefore, it’s imperative that businesses optimize the payment process.

With a seamless payment experience, they can build trust and ensure security. We will discuss the importance of this seamless experience in the next section.

If you want to learn more about your customers’ preferences and needs, you can use the given template. It’s customizable and free. Sign up to use the template.

Payment Experience Survey Template

Use This Template

The Importance of Having a Seamless Payment Experience

For your services or products, there will be payment transactions. Therefore, offering a seamless customer payment experience is the key. It can minimize friction and maximize convenience for customers.

Let’s explore why this is so crucial for businesses of all sizes and types.

1. Enhancing Customer Satisfaction and Loyalty

A smooth payment process is key to leaving a lasting positive impression on your customers.

When transactions are quick and hassle-free, customers are more likely to return and make repeat purchases. It’s about creating a sense of ease and trust among customers. They need to feel confident that their financial information is in safe hands and that the transaction will proceed without failure.

For example:

Imagine a customer trying to purchase their favorite coffee through an app. The app remembers their preferences and payment details, allowing for a transaction to be completed in just a few taps. This convenience and personalized touch encourage repeated business.

2. Impact on Conversion Rates and Overall Sales Performance

Friction in the payment process is one of the leading causes of cart abandonment in e-commerce. A complex, lengthy, or confusing checkout can frustrate customers. This can further lead them to leave without completing their purchase.

Streamlining the payment process, by contrast, can substantially increase conversion rates. You can try offering multiple payment options such as credit cards, digital wallets, and buy now, pay later services.

3. Consumer Expectations for Payment Experiences in Various Industries

Consumer expectations for payment experiences vary across industries but share common themes. They are speed, simplicity, and security.

- In the retail sector, for example, customers expect a variety of payment methods and instant receipts.

- In the travel industry, consumers look for flexible payment options, like installment payments. This way, they can make large purchases more manageable.

Likewise, there is a growing expectation for contactless payments and mobile payment options as well. This is a clear reflection of the increasing importance of convenience and hygiene. Moreover, consumers now expect personalized payment experiences.

So, it’s safe to say that businesses that meet these expectations can differentiate themselves in crowded markets.

Pro Tip: A survey will reveal your customer’s preference for payment mode.

How to Improve Payment Experience?

It’s clear as day how important it is to improve the customer payment experience. This is the case, especially if you want to increase customer satisfaction, reduce cart abandonment, and boost sales.

So, for those who want to implement a better payment experience, here are a few tricks and tips.

1. Simplify the User Interface Design

The design of the checkout page plays a significant role in the payment experience. A cluttered or confusing interface can frustrate customers and lead to abandoned carts. Here’s how to improve it:

- Clear and Intuitive Design:

Use simple, clean designs that highlight essential elements like price, payment options, and the “Pay Now” button.

- Progress Indicators:

Show customers where they are in the checkout process and how many steps remain. This transparency can reduce frustration and increase the likelihood of completing the purchase.

- Error Handling:

Clearly indicate when a mistake is made (e.g., incorrect card details) and provide helpful suggestions for fixing it. This reduces customer frustration and helps complete the transaction smoothly.

2. Offer Diverse Payment Methods

Consumers have varying preferences for payment methods, influenced by factors like security, convenience, and availability. Offering a range of options can cater to more customers:

- Credit and Debit Cards:

This is still the most common online payment method, and it ensures your checkout supports major card providers.

- Digital Wallets:

Services like PayPal, Apple Pay, and Google Wallet offer a secure and fast way to pay without entering card details each time.

- Bank Transfers and Direct Debit:

These are also popular in certain regions, and these options can cater to those who prefer not to use cards or digital wallets.

- Buy Now, Pay Later:

This option is becoming increasingly popular for allowing customers to spread the cost of their purchase over time.

3. Minimize Required Steps for Transaction Completion

Each additional step in the checkout process allows the customer to abandon their purchase. Therefore, streamlining these steps can significantly enhance the payment experience:

- Guest Checkout Option:

Not everyone wants to create an account. Offering a guest checkout can speed up the process and reduce barriers to purchase.

- Form Auto-Fill:

Utilize auto-fill technology to reduce the amount of typing a customer has to do, speeding up the process and reducing errors.

- Save Payment Information:

For registered customers, offer the option to save payment details securely for future purchases. This makes the checkout process faster and more convenient.

4. Ensure Transparency Throughout the Process

Unexpected costs or information can lead to mistrust and abandoned carts. Being upfront can help:

- Display All Costs Upfront:

Try to include shipping, taxes, and any other fees in the initial price shown to avoid surprises at the checkout.

- Clear Return Policies and Customer Support Information:

Ensure that this information is easy to find to reassure customers that support is available if needed.

5. Continuously Test and Optimize

The payment experience should not be static. Regularly testing and optimizing the checkout process can lead to continual improvements:

- A/B Testing:

Try different versions of your checkout page to see what works best in terms of layout, wording, and process.

- Feedback Loops:

Encourage and analyze customer feedback on the checkout experience to identify areas for improvement.

These are the few, but important, things you can try out to improve the customer payment experience.

Now, before you go running to implement these, you must understand what your customer preferences and needs are. As we discussed earlier, for this, you will need a robust customer feedback tool like SurveySparrow.

The tool has past experience helping companies with the same and can help you all the same.

SurveySparrow Success Story & Payment Template

PaySafe is a global leader in end-to-end payment solutions. They empower businesses and consumers to connect and transact seamlessly through capabilities in payment processing, digital wallet, card issuing, and online cash solutions.

They were accustomed to the practice of constructing surveys internally. Yet, they sought to refine the approach to generating merchant satisfaction surveys. Their aim was to make it easier to change how the surveys look and are formatted. They also wanted to use more complex questions and analyze them with an efficient tool.

Ergo, it became very clear that they needed to work with a partner who could help her make her surveys better and more effective.

Enter SurveySparrow.

They found the tool to be highly intuitive and a great value for money. Their team was able to create attractive surveys with analytical features offering real-time reporting. They were able to easily visualize and understand the customer feedback.

Or, in their own words,

Read more such success stories of SurveySparrow.

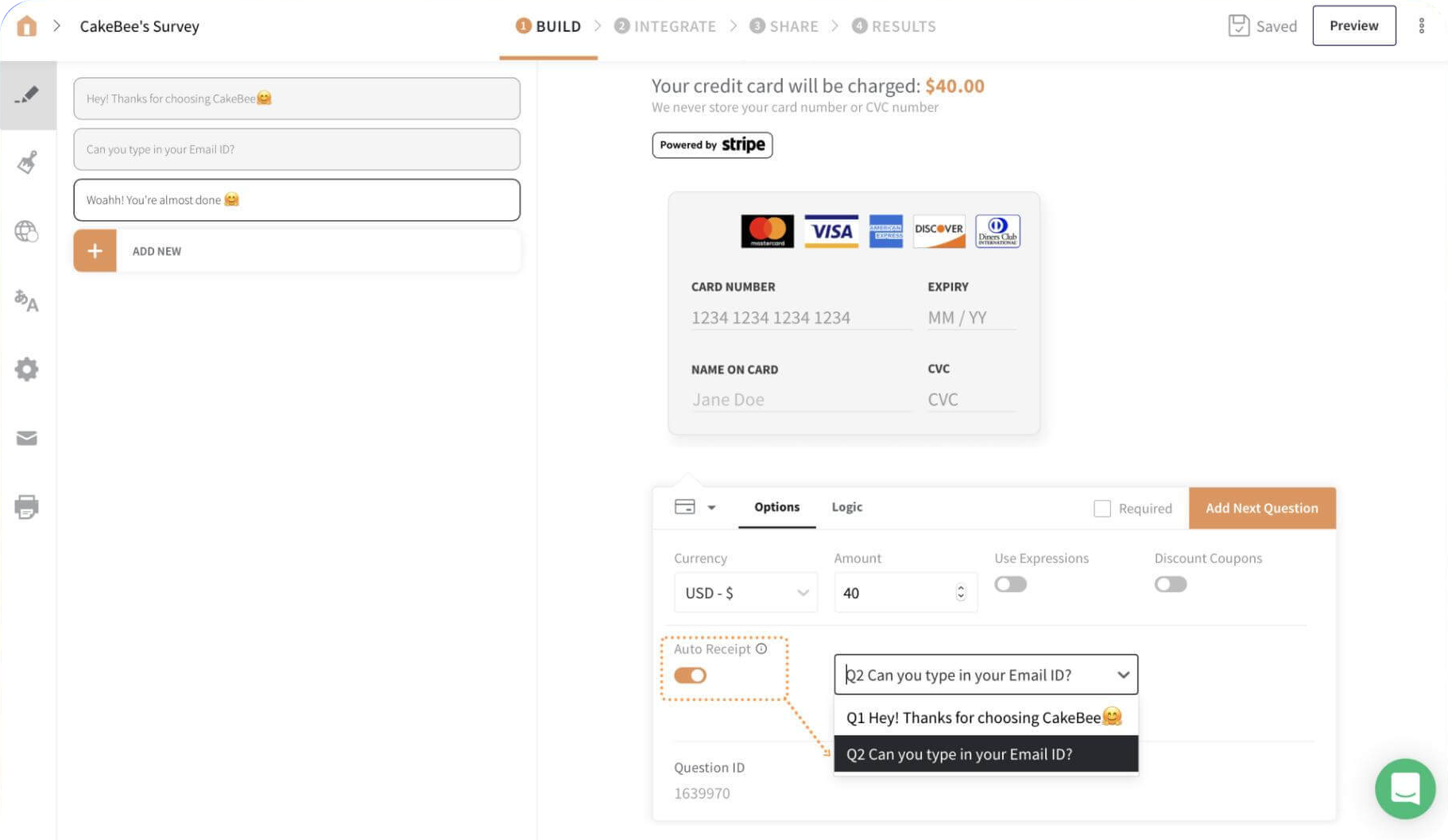

Now, for those businesses who want to keep their payment process as seamless as possible, SurveySparrow provides specific options. They can create one from scratch or customize the templates to request payment or accept one. The following is a sneak peek into how the survey will look like.

There are a lot more templates like this in SurveySparrow. You can find 1000+ templates on the platform, and it’s free. All you need to do is sign up, which is ironically free.

Explore Deeper Customer Insights with SurveySparrow

Try it for Free!

14-Day-Free Trial • Cancel Anytime • No Credit Card Required • Need a Demo?

Kate Williams

Content Marketer at SurveySparrow

Turn every feedback into a growth opportunity

14-day free trial • Cancel Anytime • No Credit Card Required • Need a Demo?