NPS survey questions examples help businesses measure customer loyalty, satisfaction, and long-term growth using the Net Promoter Score (NPS®).

At its core, NPS relies on one simple question: “How likely are you to recommend a company, product, or service to a friend or colleague?” Customers respond on a scale from 0 to 10, allowing businesses to classify them as promoters, passives, or detractors.

In this guide, you’ll find 27 proven NPS survey question examples, including standard, transactional, product-specific, service-based, B2B, mobile app, and follow-up questions you can copy and use immediately.

NPS Survey Questions Examples (27 Questions You Can Copy)

Below are 27 NPS survey question examples, grouped by use case. You can copy these directly or adapt them to your business.

Standard NPS

- How likely are you to recommend [Company Name] to a friend or colleague?

Relational NPS

- Considering your overall experience with our company, how likely are you to recommend us to a friend or colleague?

- Based on your long-term relationship with our company, how likely are you to recommend us?

Product-Specific NPS

- How likely are you to recommend [Product Name] to someone like you?

- After using this product, how likely are you to recommend it to a friend or colleague?

- After using our latest product update, how likely are you to recommend [Product Name]?

Service-Based NPS

- Based on your recent service experience, how likely are you to recommend our service?

- After completing your service appointment, how likely are you to recommend us?

Customer Support Interaction NPS

- Based on your recent interaction with our support team, how likely are you to recommend our service?

- After your support issue was resolved, how likely are you to recommend our support team?

Post-Purchase NPS

- Based on your recent purchase experience, how likely are you to recommend our brand?

- How likely are you to recommend our checkout or buying experience to others?

Transactional NPS

- Based on your most recent interaction with our business, how likely are you to recommend us?

- Following your recent interaction with us, how likely are you to recommend our company?

Onboarding, Trial & Lifecycle NPS

- How likely are you to recommend our platform after completing onboarding?

- Based on your onboarding experience so far, how likely are you to recommend our platform?

- Based on your trial experience, how likely are you to recommend our product?

- After upgrading or renewing your plan, how likely are you to recommend our product?

Digital Experience NPS – Website & App

- Based on today’s website experience, how likely are you to recommend our website?

- Based on your experience using our website today, how likely are you to recommend it?

- How likely are you to recommend our mobile app to a friend or colleague?

- After using this feature in our app, how likely are you to recommend our app?

B2B & Role-Based NPS

- How likely are you to recommend our solution to other professionals in your role?

- As a decision-maker, how likely are you to recommend our solution to peers in your industry?

- How likely are you to recommend this tool to colleagues on your team?

Employee Net Promoter Score (eNPS)

- How likely are you to recommend this company as a place to work?

- Based on your experience working here, how likely are you to recommend this company to others?

Standard NPS Survey Question Examples

A successful NPS program starts with a revolutionary customer feedback question. Let's get into what makes this question work and how you can use it in your surveys.

Below, we break down each NPS survey question example in detail, including when to use it, why it works, and best-practice timing.

Standard NPS question format

The standard Net Promoter Score question follows a specific format popularized by Fred Reichheld in the early 2000s: "On a scale of 0-10, how likely is it that you would recommend [Organization X/Product Y/Service Z] to a friend or colleague?"

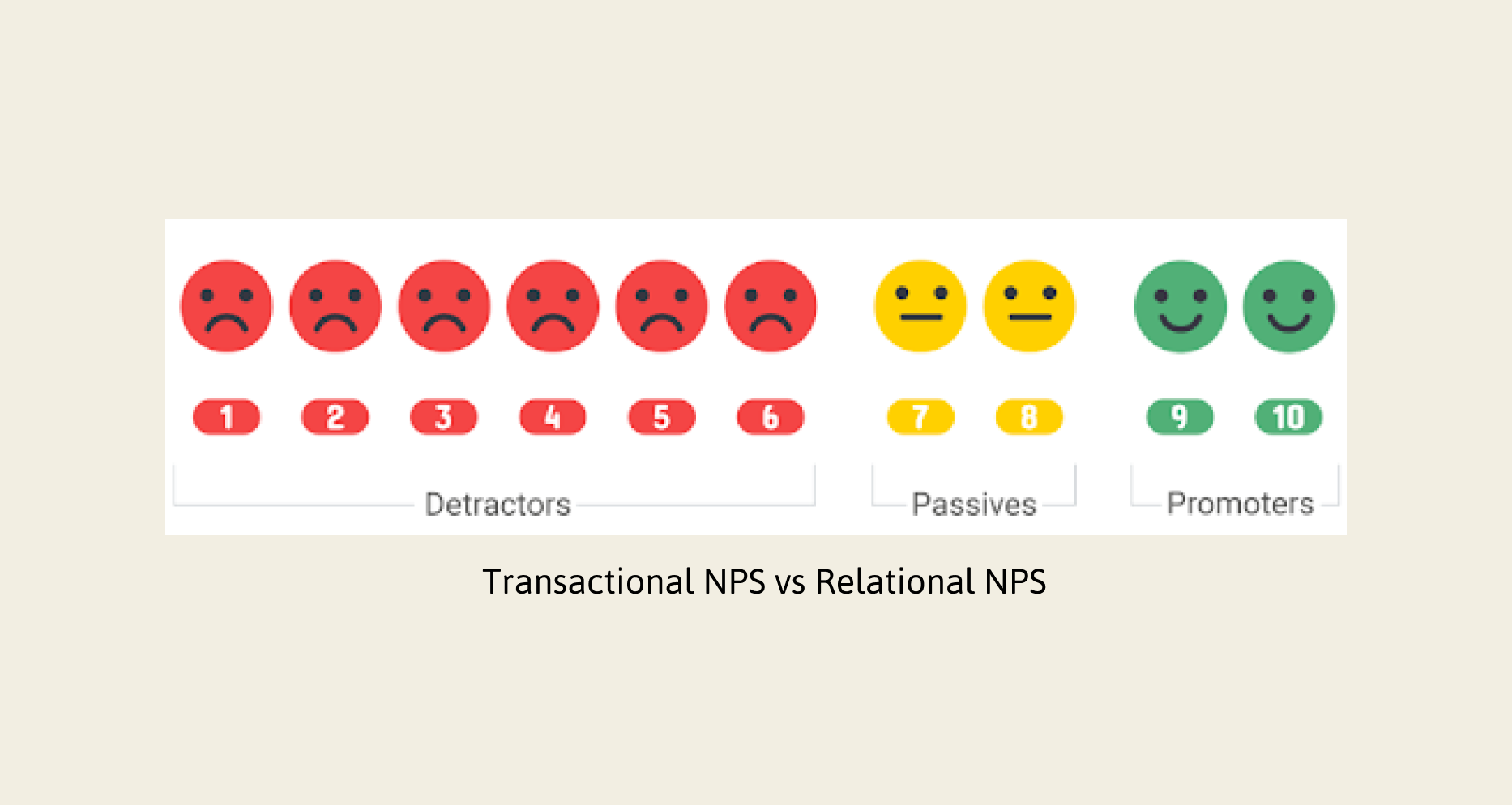

This question uses a 0-10 scale that groups responses into three categories:

- Promoters (9-10) - These customers are highly satisfied and actively recommend your business

- Passives (7-8) - These customers feel satisfied but lack enthusiasm

- Detractors (0-6) - These customers feel dissatisfied and might share negative feedback

Your NPS calculation is straightforward. Just subtract the percentage of detractors from the percentage of promoters: Promoter % – Detractor % = NPS. Scores range from -100 to +100, and higher scores show better customer loyalty.

Why it works

The standard NPS question delivers exceptional results. Research shows it associates most directly with customer renewal and repurchase likelihood compared to other loyalty questions. NPS provides a clear standard for comparison across industries and time periods.

The question's simplicity can improve responses. Customers can answer quickly, and they're more likely to participate when you add an open-ended follow-up question about their score.

When to use this question

NPS questions work best in these scenarios:

- Relational NPS surveys - Regular tracking of customer loyalty trends through quarterly, bi-annual, or yearly surveys

- Baseline establishment - Starting points for new customer feedback programs that need core metrics

- Benchmarking - Performance comparisons with competitors or industry standards

Even with a well-designed NPS question, many teams struggle to get meaningful responses—or to understand what to do with the scores afterward.

That’s why the way you collect and follow up on NPS feedback matters just as much as the question itself.

14-day free trial • Cancel Anytime • No Credit Card Required • No Strings Attached

Product-Specific NPS Question

A closer look at specific parts of your business shows how the standard NPS question becomes a more focused tool. Product-specific NPS questions help you get detailed feedback about individual offerings in your portfolio. These questions provide specific insights that general NPS questions miss.

Product-specific NPS question format

The product-specific NPS question adapts the classic template to focus on one item in your product ecosystem:

"On a scale of 0 to 10, how likely are you to recommend [Specific Product/Feature Name] to a friend or colleague?"

You might ask about PowerPoint instead of Microsoft as a whole, or a bank might focus on its mobile check deposit feature. This helps prevent one bad experience with a product from affecting your brand's overall perception.

A useful variation reads: "How likely are you to recommend our [product] to someone like you?" This works better for niche products that don't appeal to everyone.

Why it works for product feedback

Product-specific NPS questions excel because of their precision. They turn NPS from a basic brand health metric into a powerful product management tool. This connects customer feelings directly to specific development plans.

This focused approach lets you:

- Map out loyalty across your product ecosystem

- See which products build customer loyalty

- Use customer feedback to distribute resources better

Best use cases

Product-specific NPS questions give the best results in these situations:

- After meaningful product interactions - Send the survey right after customers use the specific product or feature

- For portfolio benchmarking - Look at NPS scores of different products to learn from high-performing ones

- Throughout the product lifecycle - Study scores based on how long products have been around, knowing expectations differ between new and older products

- For feature validation - Check if users like new features or if changes are needed

Service-Based NPS Question

Service excellence needs accurate measurement tools. Service-based NPS questions target customer interactions with your support team, consultants, or service providers instead of just products.

Service-based NPS question format

The service-based NPS question adapts the standard format to focus on specific service interactions: "Based on your recent [call/support interaction/service appointment], how likely are you to recommend our service?"

You can also phrase it as: "How likely are you to recommend our [specific service] to friends, family, or business associates?" This format works best after customer service interactions, technical support calls, or completed service deliveries.

Why it works for service industries

Service-based NPS excels at measuring satisfaction at specific service touchpoints. These transactional surveys break down customer experiences at exact points in their customer's trip, unlike relationship surveys that measure overall brand perception.

This approach helps you:

- See which service interactions create promoters or detractors

- Spot knowledge gaps in your service team

- Track service delivery improvements over time

Service-based NPS combined with relationship surveys gives you insights that relationship surveys alone can't provide.

Some telecom providers have found that combining relational and transactional NPS reveals different operational issues at various service touchpoints.

Best use cases

Service-based NPS questions work best when sent:

- Right after closing a support ticket

- After service appointments or consultations

- Once installation or implementation ends

- After resolving customer complaints

You should set up "throttle rules" to limit surveys to once every 90 days per customer to avoid survey fatigue, even if they interact with your service team more often.

Post-Purchase NPS Question

Customer feedback collected at the significant moment after purchase helps us learn about their buying experience. The post-purchase NPS questions target the transaction process instead of overall brand perception.

Post-purchase NPS question format

The post-purchase NPS question follows this format: "On a scale of 0 to 10, based on your recent purchase experience, how likely are you to recommend [Company/Brand] to a friend or colleague?"

This question measures sentiment about the buying trip—from product finding through checkout completion. The question targets specific elements like website navigation, checkout process efficiency, and payment options by focusing on "recent purchase experience".

Why it works for eCommerce

Post-purchase NPS questions perform well because they measure sentiment during peak engagement and expectation. This timing helps you identify problems in your conversion funnel before they impact future customers.

A low score typically points to checkout process issues rather than product problems (which customers haven't experienced yet). Customers' experiences stay fresh in their minds without affecting product delivery excitement when surveyed within 24-48 hours of purchase.

Best use cases

These surveys work best when deployed:

- Immediately after online orders (0-24 hours) for digital products

- Within 0-3 days for physical products requiring testing

- 7-10 days after purchase when shipping is involved

Many apparel brands send post-purchase NPS surveys a few days after delivery so customers have time to try the product. This timing allows customers to try items while their memories remain fresh. This makes sure that they collect applicable feedback that improves conversion rates directly.

Onboarding Experience NPS Question

The onboarding phase is a vital moment that shapes how customers will view your product long-term. You can learn a lot about your user experience by measuring satisfaction at this key stage.

Onboarding NPS question format

The standard onboarding NPS question typically reads: "How likely are you to recommend our platform after completing onboarding?"

This question focuses on getting feedback about the setup experience. SaaS companies might get better results with: "Based on your onboarding experience so far, how likely are you to recommend our platform to a colleague?"

Why it works for SaaS

SaaS companies find onboarding NPS particularly valuable because the first few payment cycles play a big role in keeping new subscribers happy. Getting feedback early helps spot potential customer drop-off risks quickly.

Yes, it is helpful to measure satisfaction at different touchpoints to see exactly where users struggle or succeed. When customers give high NPS scores after onboarding, it shows your setup process has prepared them well for the long run.

Best use cases

These NPS questions work best when you send them:

- Right after the main onboarding steps

- Once users have tried specific features multiple times

- After they've used the product or upgraded their plan

The ideal time to ask is after customers hit their first big milestone or "eureka moment".

Customer Support Interaction NPS Question

Customer relationships often hinge on support interactions. You can turn service fixes into loyalty opportunities by asking the right NPS question after solving problems.

Support NPS question format

Post-support NPS questions usually work like this: "Based on your recent interaction with our support team, how likely are you to recommend our service to a friend or colleague?"

You can make it individual-specific by focusing on the agent: "How likely is it that you would recommend [Support Agent Name] to a friend or colleague?" This helps you rank customer service team members through direct feedback and shows where training might help.

Why it works for service recovery

The "service recovery paradox" makes support NPS questions powerful. When you handle problems well, customers become more loyal than if they never had issues.

Service recovery is often cited as a reason why well-handled support interactions can improve customer loyalty. Using feedback from support interactions can help businesses identify recovery opportunities that strengthen long-term customer relationships.

Best use cases

Support NPS questions work best when you send them:

- Right after closing support tickets

- Once complaints get resolved

- After you fix previous issues

You need "throttle rules" to avoid survey burnout. These rules should limit surveys to once every 90 days for each customer, whatever the number of interactions.

Employee Net Promoter Score Question

Employee sentiment measured through eNPS surveys tells you a lot about your organization's health, beyond just customer satisfaction.

eNPS question format

The main employee Net Promoter Score question usually asks: "On a scale of 0 to 10, how likely are you to recommend this company as a place to work?"

Organizations can choose between:

- 11-point scale (0-10) - This traditional format classifies employees scoring 9-10 as Promoters, 7-8 as Passives, and 0-6 as Detractors

- 5-point scale - This uses "I would recommend [Company Name] as a great place to work" statement

The eNPS calculation subtracts the percentage of Detractors from Promoters to get a score between -100 and +100.

Why it works for internal feedback

Employee Net Promoter Score works well to measure engagement because it:

- Gives a clear metric that links directly to employee satisfaction and loyalty

- Lets employees share honest feedback about workplace culture anonymously

- Helps compare results across departments over time

Employee engagement is commonly associated with stronger retention and long-term employee satisfaction. This is the reason why eNPS is a reliable way to predict retention. The score combined with qualitative follow-up questions provides better insights than standard employee surveys.

Best use cases

You'll get the most value from eNPS questions when you:

- Run surveys quarterly to track trends without causing survey fatigue

- Add open-ended questions like "What prevents you from recommending this company?"

- Keep responses anonymous to get honest feedback

- Make it part of a detailed feedback system that measures different aspects of employee experience

Relational NPS Survey Question

Your brand's relationship with customers needs a different approach than measuring specific interactions. NPS surveys are a great way to get this information.

Relational NPS format

Relational NPS surveys ask the fundamental question: "How likely are you to recommend [Company Name] to a friend or colleague based on your overall experience?"

These surveys measure customers' integrated perception of your brand, unlike transaction-specific surveys. The question stays consistent with standard NPS structure, but the timing and context are completely different.

Why it works for long-term tracking

Relational NPS acts as a "health check" for your brand and helps measure data for year-over-year improvement. Similar to regular medical checkups versus emergency visits, these surveys show trends and seasonal patterns that transaction-focused metrics miss.

Your relational NPS works like an early warning system. Dropping scores indicate eroding customer trust even when transactional feedback looks positive.

Best use cases

Relational NPS surveys work best when you:

- Set consistent intervals - Quarterly, biannually, or annually to establish reliable trends

- Schedule smartly - Skip holidays or high-volume sales times

- Plan strategy - Use data to improve customer trips at a high level

- Connect with new subscribers - SaaS companies should collect after 90 days of usage, then quarterly

Transactional NPS Survey Question

Transactional NPS measures specific customer interactions at key touchpoints throughout their experience, unlike relationship-focused metrics that look at overall sentiment.

Transactional NPS format

Transactional NPS surveys adapt the standard question to focus on a specific interaction: "Based on your recent [specific touchpoint], how likely are you to recommend our business to a friend or colleague?"

Practical examples include:

- Post-purchase: "Based on your recent purchase, how likely are you to recommend our website to friends and family?"

- Feature usage: "Having tested our new [feature], how likely are you to recommend it to a colleague?"

- Support interaction: "Following your recent interaction with our support team, how likely are you to recommend our service?"

The calculation matches standard NPS—subtracting the percentage of detractors from promoters—which gives a score between -100 and +100.

Why it works for real-time feedback

Transactional NPS works best by gathering instant feedback while experiences stay fresh in customers' minds. These targeted insights help you identify which touchpoints create promoters or detractors.

Transactional NPS turns passive scores into active learning systems. It combines quantitative ratings with qualitative context and uncovers the vital "why" behind customer sentiment.

At this stage, many teams realize the challenge isn’t collecting NPS scores—it’s acting on them quickly enough without overwhelming customers or internal teams.

Using smarter survey timing, targeted follow-ups, and automated workflows can make a noticeable difference here.

14-day free trial • Cancel Anytime • No Credit Card Required • No Strings Attached

Best use cases

Transactional surveys provide maximum value when used:

- Immediately after interactions (support tickets, purchases, feature usage)

- At high-volume touchpoints where satisfaction directly affects retention

- To optimize experience at specific stages of the customer's journey

In spite of that, you should avoid survey fatigue. Experts suggest waiting 7-15 days between surveys for each customer.

Follow-Up: Why Did You Give That Score?

The real value of NPS emerges as we learn about the reasons behind customer scores through strategic follow-up questions.

Follow-up question format

A simple yet powerful classic follow-up question works best: "What's the biggest reason for the score you gave us?" or simply "Please tell us why you gave that rating." Customers can explain their numerical rating in their own words through this open-ended format.

These variations work well:

- For detractors: "We're sorry to hear that. What would you like us to improve on?"

- For passives: "Thank you for your feedback. Would you like to tell us why you scored us that way?"

- For promoters: "We're glad you like us. Would you like to tell us what exactly excites you?"

Why it works

This follow-up turns NPS from a numerical standard into practical feedback. Your NPS becomes just a vanity metric without proper context.

Open-ended NPS follow-up questions often receive strong participation and provide richer qualitative feedback than closed-ended questions alone.

Best use cases

Your follow-up question works best when you:

- Place it right after the main NPS question

- Use guided prompts based on score ranges

- Combine it with text analysis tools to spot patterns

- Ask it before any multiple-choice questions

Follow-Up: What Did We Do Well?

Finding what makes your customers happy is as valuable as spotting their pain points. A well-crafted "What did we do well?" question draws out positive feedback that helps strengthen successful practices.

Follow-up question format

The positive follow-up question appears as: "What features of our service impressed you the most?" or "What did you love most about our service?"

For individual-specific approaches based on NPS segments:

- For Promoters: "We're thrilled you feel that way. Care to tell us why?"

- For all respondents: "Thanks for that great feedback! Which features of our service impressed you the most?"

Why it works

We focused on positive questions to balance our feedback collection strategy beyond problem-fixing. These questions help us learn about your strengths that you can reinforce or expand strategically.

Your acknowledgment of customer satisfaction shows them you care about their feedback, not just checking boxes. The way you frame questions in your brand's unique voice—whether super friendly, business-like, or modern and fun—shows thoughtfulness and encourages detailed responses.

Best use cases

Use positive follow-up questions:

- After high NPS scores to understand what drives promoter behavior

- To gather testimonial content for marketing

- To identify strengths for competitive positioning

- As part of a targeted approach where promoters get different questions than detractors

These questions often encourage customers to share detailed feedback when given the opportunity.

Follow-Up: What Can We Improve?

Getting better at identifying areas that need improvement is the life-blood of any feedback system that works. The right follow-up question can turn general dissatisfaction into specific, practical insights.

Follow-up question format

Direct questions work best to focus on improvements like: "What can we do to improve your experience?" or "What would you change about our product/service?"

Questions for detractors should be: "What was the most disappointing aspect of your experience with us?" or "How did our product/service fail to meet your expectations?"

Questions for passives (7-8 scores) can be: "What's holding you back from giving us a higher score?" These responses help you make small changes that turn these customers into promoters.

Why it works

Questions about improvements see high participation rates. Research shows 82% of people answer such questions when you ask them right. The results are even better when 44% of participants leave detailed feedback.

These questions reveal hidden operational weak spots. Your NPS becomes just a vanity metric without understanding the reasons behind the scores instead of a practical tool.

Best use cases

You should ask improvement questions:

- Right after low or moderate NPS ratings

- As part of a well-laid-out approach with different groups getting specific follow-ups

- While using text analysis tools to spot common themes

- Along with asking "may we contact you to discuss your experience in more detail?"

The best way to build trust in your NPS program is to take visible action based on feedback. Small changes matter when customers see you listened to what they said.

Follow-Up: What Would WOW You?

You need to understand what truly impresses your customers to exceed their expectations. The "wow factor" question helps find opportunities that turn satisfied customers into enthusiastic promoters.

Follow-up question format

The wow question typically appears as: "What could we do that would absolutely wow you about our service?" or "What one change would make you say 'wow' about our product?"

A more tailored approach works better: "Think about the best [product/service] experience you've ever had. What made it exceptional, and how could we provide something like that?" This question helps customers think beyond simple satisfaction and foresee ideal scenarios.

Why it works

This approach finds hidden needs and expectations that standard questions miss. Regular improvement questions spot problems. Wow questions reveal what customers really want and turn promoters into brand champions.

These questions also show customers you want to go beyond just being good enough. Your steadfast dedication to exceptional experiences makes a difference.

Best use cases

The best times to use wow questions:

- Right after standard follow-ups to go beyond fixing problems

- With 6-month old customers who know your offering well enough to suggest improvements

- During strategic planning for product development

- When looking for ways to stand out from competitors

Once you start collecting open-ended NPS feedback at scale, the real challenge becomes organizing and acting on those insights consistently.

Some teams use NPS tools that automatically route feedback, analyze sentiment, and close the loop with customers—helping turn qualitative responses into concrete improvements without manual effort.

SurveySparrow NPS Survey Template

Want a simpler way to set up NPS surveys that work? SurveySparrow's templates give you a ready-to-use framework that turns NPS concepts into practical feedback systems.

SurveySparrow features

SurveySparrow's NPS platform stands out because its conversational survey format gets up to 40% higher response rates reported by customers using conversational surveys than traditional forms. You can customize everything - add your logo and brand colors or personalize follow-up questions for promoters, passives, and detractors.

The platform goes beyond simple surveys with:

- Up-to-the-minute data analysis that reveals customer emotions

- Optimized workflows that send feedback to the right teams

- Smart throttling that prevents survey fatigue by spacing out feedback requests

Why it works

SurveySparrow connects feedback collection with action. The dashboard shows your NPS trends visually, so you can track scores daily, weekly, or monthly. You can segment respondents based on any criteria to understand customer personas better.

The system creates tickets from feedback automatically and assigns them to team members who can resolve issues. This closes the feedback loop that many companies find hard to maintain. Such an approach turns passive data collection into an engine for improvement.

Best use cases

SurveySparrow works well in many industries:

- E-commerce: Analyzes customer sentiments to understand priorities and improve user experience

- Healthcare: Groups patient feedback to improve care quality and communication

- Software Development: Spots strengths and weaknesses through detailed user sentiment tracking

The platform now serves over 4000 teams in 149 countries, showing how well it adapts to different feedback needs.

NPS Question for Specific Personas

NPS surveys customized to customer personas work better than generic ones. These targeted surveys give specific insights about different customer segments.

Persona-based NPS format

The NPS questions adapt their wording to match different customer groups:

- For new users: "As someone new to [Product], how likely are you to recommend us?"

- For loyal customers: "Based on your long-term experience, how likely are you to recommend us?"

- For specific roles: "As a [job title], how likely would you recommend our solution?"

This approach turns standard surveys into powerful feedback tools that work for specific touchpoints and customer segments.

Why it works

These targeted surveys help you learn about different customer experiences and highlight areas that need improvement. The feedback comes from customers who have relevant, recent experiences with your product.

Your NPS data becomes more valuable when you break it down by customer type. This breakdown shows which groups succeed and which need help. Clear patterns emerge - enterprise customers might love certain features while small teams find them challenging.

Best use cases

You should use persona-based surveys to understand how different segments react to your product. Customers who give high scores (9-10) help create accurate buyer personas. Their feedback reveals common traits that strengthen customer profiles for targeted marketing campaigns.

NPS Question for Website Experience

Your website is your business's digital storefront. You need constant feedback about user experience. Website-specific NPS surveys help you learn about user trips that generic questions might miss.

Website NPS format

Website experience NPS questions target the digital interaction: "Based on your experience using our website today, how likely are you to recommend it to a friend or colleague?"

You can also try: "How likely are you to recommend our website to someone with similar needs?" This question works well when you add it to your site through pop-ups or feedback widgets.

Why it works

Website NPS measures user satisfaction with your digital experience by separating website interactions from overall brand perception. These targeted questions help us find specific pain points in navigation, content, or functionality that could stay hidden otherwise.

Website NPS also gives you a clear metric that associates with usability. This becomes valuable especially when you have to show UX improvement ROI to leadership teams.

Best use cases

Use website NPS surveys:

- Right after key interactions (purchases, form submissions, account creations)

- During regular website evaluations

- After major redesigns or feature launches

- With segments based on traffic source, device type, or user demographics

NPS Question for Mobile App Users

Mobile apps create unique feedback challenges because of limited screen space and user attention. Creating effective NPS questions in this environment needs careful thought about format and timing.

App-based NPS format

Mobile app NPS questions should be short but engaging. The standard format works well on smaller screens:

- Standard mobile NPS: "How likely are you to recommend [app name] to a friend or colleague?"

- Emoji-based: "How do you feel about [app name]? 😍 😊 😐 😕 😢"

- Thumbs up/down: "Would you recommend us? 👍 👎"

- Feature-specific: "After using [specific feature], how likely are you to recommend us?"

Visual rating scales like emojis are often used to make responses faster and easier on mobile devices. Users find them easy to understand and tap-friendly.

Why it works

Users give feedback through in-app surveys while they actively use the app and their experience stays fresh. This timing in context results in more accurate, honest responses compared to delayed email surveys.

Mobile NPS works best because it reaches users right after they complete key actions—when they finish core tasks, unlock features, or achieve milestones. The response rates are much higher now because users stay in the same application.

Best use cases

The best times to trigger mobile NPS surveys are:

- Right after users complete a purchase or core workflow

- When they first try a "sticky" feature

- As they reach key milestones (10th login, sharing content)

Users should see surveys once every quarter to avoid survey fatigue. Many modern feedback tools support both web and mobile platforms through SDKs or integrations

NPS Question for B2B Clients

B2B feedback needs a different approach compared to consumer surveys. Complex organizations require role-specific points of view to gather applicable information.

B2B NPS format

Role-based questions yield the best B2B feedback results:

For Decision Makers: "On a scale of 0-10, how likely are you to recommend our solution to other leaders responsible for [business function]?"

For End Users: "How likely are you to recommend this tool to colleagues in your role?"

For Technical Evaluators: "Would you recommend this platform to other technical teams based on your setup experience?"

Why it works

B2B trial users assess solutions on behalf of their teams. They look at integration, process fit, and organizational challenges. B2B NPS response rates vary widely based on audience, timing, and relationship context.

Account-level targeting helps questions reach the right stakeholders. This matters because people within your account often have different opinions.

Best use cases

B2B NPS surveys work best:

- After trial periods

- At relationship milestones (quarterly/annually)

- With account-based targeting for different roles

- Using conversational AI that adapts follow-ups based on original responses

Comparison Table

| NPS Question Type | What It Measures | When to Use It | Why It’s Useful |

|---|---|---|---|

| Standard NPS | Overall brand loyalty | Periodic check-ins (quarterly/annually) | Tracks long-term customer sentiment |

| Product NPS | Loyalty to a specific product or feature | After product usage | Identifies strengths and weaknesses at product level |

| Service-Based NPS | Satisfaction with service interactions | After support or service delivery | Highlights service quality and recovery opportunities |

| Post-Purchase NPS | Purchase and checkout experience | Shortly after purchase | Detects friction in the buying process |

| Onboarding NPS | Early user experience | After onboarding completion | Identifies early churn risks |

| Support Interaction NPS | Support effectiveness | After ticket resolution | Improves customer support performance |

| Employee NPS (eNPS) | Employee engagement | Regular internal surveys | Gauges workplace satisfaction |

| Website Experience NPS | Website usability | After key website actions | Improves digital experience |

| Mobile App NPS | In-app experience | After core actions or milestones | Captures feedback in real usage context |

| B2B NPS | Account-level loyalty | Relationship milestones | Reflects satisfaction across stakeholders |

These NPS survey question examples are based on widely adopted customer experience frameworks and are used by SaaS, eCommerce, B2B, and service-based businesses to measure loyalty and improve retention.

Conclusion

NPS surveys help businesses understand and improve their customer experience by collecting meaningful feedback. This piece shows how tailoring NPS questions to specific scenarios yields more useful insights than generic approaches. The standard NPS question serves well as a baseline metric, but the true value emerges from customizing questions for product interactions, service experiences, post-purchase moments, and other key touchpoints.

Follow-up questions such as "What did we do well?" and "What can we improve?" provide the significant context needed to turn data into action. Your NPS remains just a vanity metric without this qualitative feedback instead of becoming a catalyst for genuine improvement.

The best NPS question formats should match your specific business context. Website experience surveys work perfectly for e-commerce businesses, while B2B companies benefit from role-specific questions that target different stakeholders. Mobile app users respond better to visual rating scales, and onboarding surveys catch issues early before they affect retention.

Begin with one or two carefully selected NPS question types and expand your program as you build confidence. The most effective NPS strategy focuses on creating a continuous feedback loop that drives meaningful improvements rather than just collecting scores. Your customers have valuable insights ready to share—you just need to ask the right questions in the right way.

If you’re looking to run NPS surveys that feel more conversational and actually lead to action, tools like SurveySparrow can help streamline the process—from survey delivery to follow-ups and analysis.

That said, the most important step is starting with the right questions, asking them at the right moments, and closing the loop with customers. The frameworks in this guide give you everything you need to do exactly that.

14-day free trial • Cancel Anytime • No Credit Card Required • No Strings Attached